when & how to invest in shares

When and how should you invest in shares? Here’s Glen James’s tips on when and how to invest in shares – have a read if investing in shares is something you're aiming for, particularly if you're a newbie. Also subscribe to my millennial investor to near what Nick Bradley has to share about investing!

when to start investing in shares?

answer: once you’ve mastered your sound financial house

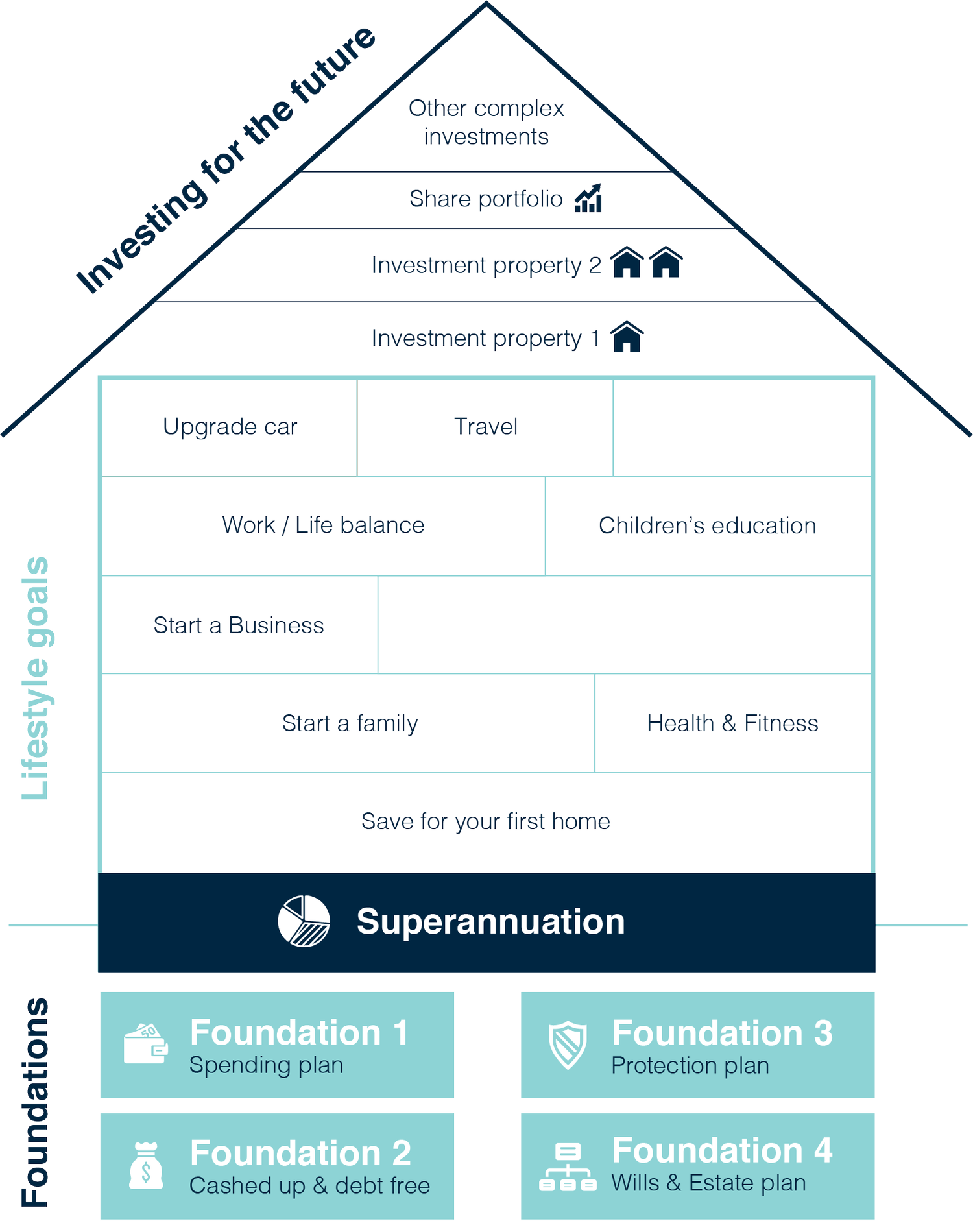

As a former financial adviser, Glen James encouraged his clients to set up a sound financial house before getting started on things like investing in shares. He taught this idea with a diagram showing you the foundational aspects you should set up to get your money sorted, before you start investing in things like shares and property. The major aspects to get sorted before you start investing in shares are:

a) your consumer debt is paid off

Consumer debt includes things like car loans, personal loans, credit cards and buy-now-pay-later schemes. While you may feel like you’ve only borrowed a small amount, these loans impact your finances hugely. They choke your cash flow week to week, they’re super hard to shake and they indicate a spending problem. Kick those debts away, close the accounts and cut up the cards, and focus on using cash to buy the things you need. The underlying problem is your spending habits - focus on fixing those.

b) you have a spending plan in place

You need to have a money management system that works for you - there is no one way to do this as all of our situations are different. The one that works for you is the right one. Glen James has a spending plan that suits a bunch of people, but like all personal finance it’s personal - you might want to tweak it to suit your needs. If creating a budget or spending plan is actually your worst nightmare then now is the time to get educated and maximise the systems others have developed. We need to get a system working well that balances your income and expenses so you’re spending less than you earn, everything is accounted for and you’ve automated things as much as possible!

c) you’ve got your protection plan sorted

A major plan for many Millennials is getting personal life insurances in place to protect income and provide assurances to family and friends that if the worst should happen to you, there’s a support system in place to help manage financial and personal issues. Check out this detailed blog where Glen James explains how these insurances work and pro-tip: the help of professionals in this space is a must!

d) you have an emergency fund established

Nobody knows when disaster will strike! In a flash you could crack a tooth, the garbage truck could swipe your car off the street until it’s a write-off, or your cute kitten might need emergency surgery. Where will you get the money to sort these out? Not your everyday spending, that’s for sure. Setting up an emergency fund creates a financial buffer around your finances so if anything knocks it, like an emergency, your system will not topple over. Protect your finances and build an emergency fund, like a moat around a castle. Around 3-6 months worth of expenses is key.

e) your superannuation is being invested into regularly

Superannuation is a brilliant way to build wealth for your future and ensure you have what you need to enjoy your retirement years. If you have 17 super accounts, now’s the time to consolidate them. If you have lost super - reclaim it! If a previous employer owes you superannuation, report them to the Australian Taxation Office. Check your payslips and ensure that your employer is contributing to your superannuation on a regular basis, and to the legal minimum requirements. If not, it’s time to have a polite discussion to make it so. If you’re self-employed, now is the time to ensure you’re including super contributions as a part of your business finance plans - you must prioritise investing in your future as much as the business.

f) your life goals - short and long term - are underway

These are the more fun things we get to spend our money on in our lifetimes! Maybe you want to buy your first home, travel, pay for private schooling for your kids, upgrade the car and so on. These are the aspects that come after your core expenses needed to live, and these are the awesome things that bring joy and value to our lives. Find a way to achieve them within your budget!

how do you start investing in shares?

answer #1: systematically, not sporadically

Investing is for the long term. You don’t throw money in shares today, and pull it out next week - you will have gained nothing. Invest each week, fortnight or month or at your own predetermined frequency - it can be handy to align it with when you get paid. By being systematic we bring the emotional reactiveness meter down a few notches - it prevents you from reacting (or possibly overreacting) to market shifts (good or bad). If human emotions get involved, a magic math formula appears which looks like greed + desperation = broke. You’ll see better returns if you just systematically invest your money and let it do it’s thing. Take a chill pill, keep investing, don’t watch too closely to how it all performs. Ride it out.

answer #2: once you’ve educated yourself around investing

Investing jargon is real! Trying to understand it all can feel daunting. Get your headphones on and start surrounding yourself with the language of it by following podcasts like my millennial money and my millennial investor. Get familiar with basic investing terms. Join online communities where people talk about investing and ask questions. Read blogs and sign up to online courses about investing. Read books!

Also get familiar with all the ways you can invest and the brokers and platforms available to you. See what others are using and trial them for yourself. From micro-investing to online brokers - there’s a bunch of options to get you started. Get to know their features and try the ones that suit your goals.

answer #3: once you’ve considered how superannuation fits into your strategy

Investing money into you superannuation is a tax-effective way to build wealth! As a part of your sound financial house you’ve already ensured it’s looking healthy and your employer is contributing to you, why not contribute more to it yourself? Think through your personal strategy on this and consider if investing through brokers or platforms and/or your superannuation tickles your fancy more and set things up to work hard no matter where your money is invested.

Where to next?

subscribe to the my millennial investor podcast

Read our blog with 9 investing basics every beginner should know